Revenue & Cost Forecast

Fleet Composition (Y7)

Detailed Pro Forma

| Category | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

|---|

A scaled, asset-based, temperature-controlled transportation and logistics platform with $1.0B annual revenue, 3,000+ power units, and a multi-decade operating history serving America's essential supply chains.

Long-haul, temperature-controlled freight serving protein, produce, grocery, beverage, pharmaceutical, and high-value cargo. Emphasis on safety, compliance, and reliability.

Customized, multi-year contracted fleets for large customers. Predictable revenue, strong pricing power, and low churn. Focus area for expansion: 800 → 2,000+ trucks.

Asset-light brokerage and freight management. Enhances customer stickiness and network efficiency. Provides flexibility during market volatility.

Project Celsius transforms this proven platform into something unprecedented: a Precision Truckload operation applying scheduled railroading principles to highway freight. The existing OTR infrastructure provides the scale, customer relationships, and operational expertise. Celsius adds the network design, cadence discipline, and autonomous readiness that unlock the next tier of margin and growth.

Expand Dedicated fleet from ~800 to 2,000+ trucks. Customer penetration and share expansion. Pricing recovery as capacity rationalizes.

Target 4-6 mid-sized or 1-2 large acquisitions. Focus on succession issues, under-optimized operations, capital constraints. Pre-screened pipeline across regions.

Cost synergies from scale. Network optimization. Technology-enabled productivity. Autonomous and semi-autonomous initiatives over medium term.

An engineered, time-definite operating system applying Precision Scheduled Railroading (PSR) principles to highway freight. Not a traditional trucking operation—a network designed for repeatability, cadence, and velocity.

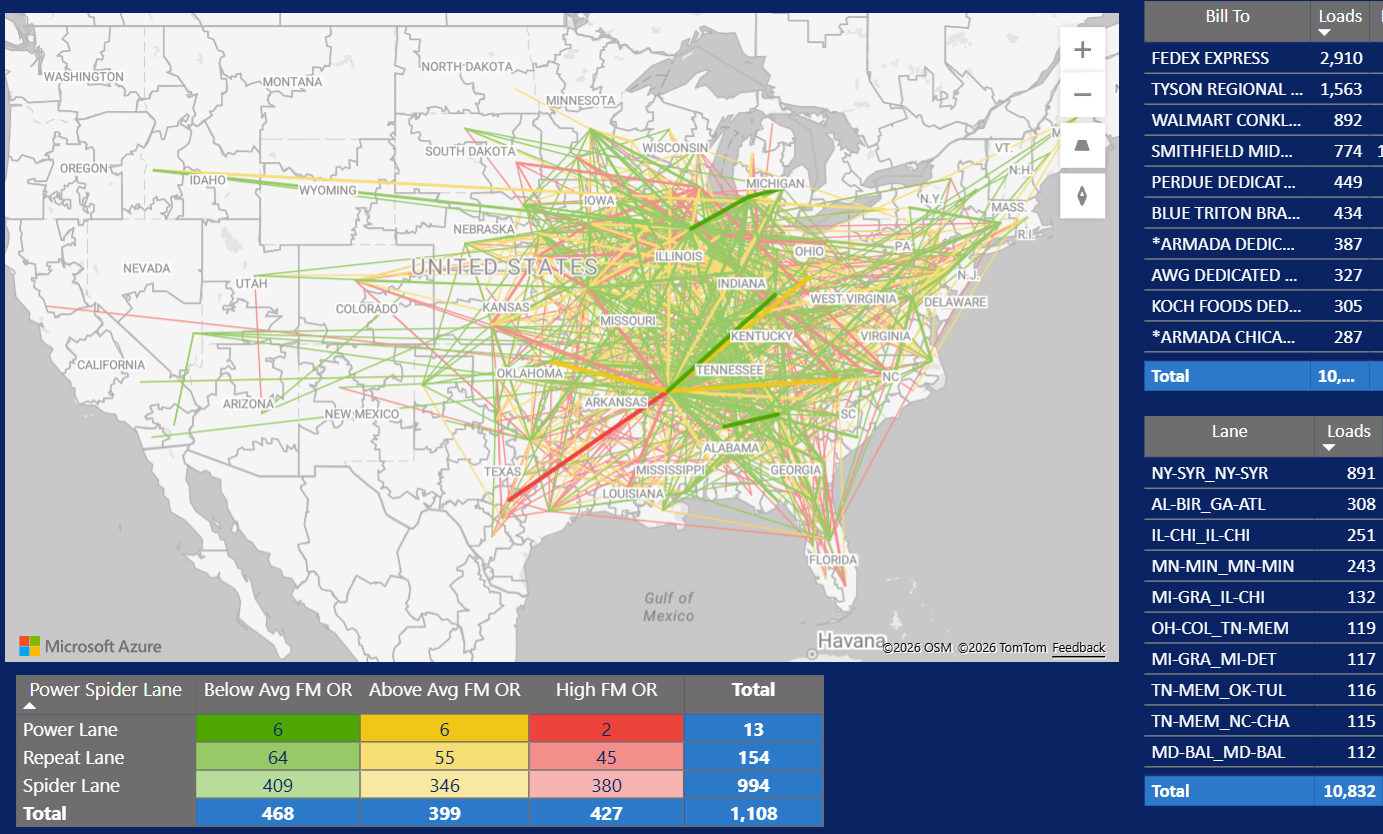

FREIGHTMATH DASHBOARDData period: October 25, 2025 – January 10, 2026 (post volume expansion)

Avoid accepting opportunistic freight that degrades network velocity, regardless of external market rates. A line must be drawn in the sand.

Accept that infrastructure is a core operating cost and fund it ahead of the curve to prevent bottlenecks.

Ultimately, Celsius is building a machine that converts Miles into Margin more efficiently than any competitor. The near-term goal is to scale this machine while protecting the discipline that makes it profitable.

Click each section to expand full details

The Expedited Network operates within the Company's OTR temperature-controlled platform but functions as a distinct product. While it shares assets, it does not share the same operating philosophy. OTR seeks optimization; Expedited seeks repetition.

The structure mirrors Less-Than-Truckload (LTL) linehaul logic: scheduled departures, defined routes, and strict timing. However, this is executed in the high-variance environment of refrigerated truckload freight.

To prevent operational drift, the network enforces four engineered standards

Not all freight fits the network. Onboarding requires strict appointment discipline, specific yard processes, and agreed-upon escalation protocols.

Stability is achieved through "low-water-mark" volume protections and, where feasible, take-or-pay contracts.

Lanes are designed with repeatable launch points and predictable cycle times. The mandate is to run the schedule, not just the load.

The cost model must allocate specific expedited support costs (security, trailer positioning, yard labor) to the lane, ensuring leadership sees real unit economics.

Less speculation on capacity. The network grows through a staged "prove-it" process.

Identify high-potential lanes with consistent volume and committed customers.

Run the lane using OTR assets first. This validates facility readiness, dwell times, and freight consistency without stranding expensive expedited assets. Earn while you learn.

Only once the lane demonstrates repeatable cycle times and stable utilization, can it be marked for inclusion to the dedicated Expedited.

The goal is to move from "managing chaos" to "managing exceptions."

In the near term, monetize reliability, not price.

In the Celsius Expedited Network, autonomous trucking is not treated as a novelty or an experiment—it is the ultimate realization of the Precision Truckload thesis. The expedited network is engineered to reduce variability for human drivers; that same engineering makes it the ideal operating environment for AV technology.

While traditional carriers view autonomy primarily as a labor solution (replacing the driver), Celsius views it as an Asset Utilization Solution. The goal is to decouple revenue generation from human physiological constraints.

Standard OTR trucks are legally capped by Hours of Service (HOS)—an 11-hour driving window followed by a mandatory 10-hour reset. This effectively idles the revenue-generating asset for 50%+ of its available life.

AV units operate strictly on the long-haul middle mile (e.g., Dallas terminal to LA drop lot). They do not perform pickup or delivery (P&D).

By eliminating mandatory sleep breaks, an autonomous tractor can operate 20–22 hours per day, stopping only for fueling and safety checks.

A human driver averages ~500 miles/day. An AV unit averages ~900–1,000 miles/day. This effectively doubles the revenue production of a single capital asset (the tractor) without doubling the fleet size.

Autonomy fundamentally alters the unit economics of the lane.

In a time-definite network, variance is the enemy. Humans introduce variance (sick days, family emergencies, fatigue management). Robots offer predictable consistency.

An AV unit traveling from Laredo to Detroit has a predictable transit time with a variance of minutes, not hours. This allows dispatchers to tighten appointment windows and reduce "buffer time" in the schedule.

A significant portion of expedited margin is lost to "service recovery"—paying for repowers, last-minute relays, or team drivers to save a late load. AV reliability drastically reduces the frequency of these expensive operational "band-aids."

Celsius will not flip a switch to full autonomy. They are executing a staged Hybrid Deployment Model:

Human drivers validate the lane: the facility processes, the gate times, and the customer volume.

AV units run the middle mile with a safety driver present to intervene if necessary. This gathers data and maps the route nuances.

Fully autonomous operation on the interstate leg. Human "drayage" drivers handle the complex first and final mile (shipper to terminal / terminal to receiver).

The Celsius Expedited Network is transitioning from design to execution. By applying "Precision Truckload" principles, they have already proven that a scheduled, engineered model outperforms traditional OTR in both margin (86.2 OR vs 108.6 OR) and velocity.

Success moving forward requires rigid adherence to two rules:

Avoid the temptation to accept opportunistic freight that degrades network velocity, regardless of the level of external traditional truckload market rates. A line must be drawn in the sand.

Accept that infrastructure is a core operating cost and fund it ahead of the curve to prevent bottlenecks.

Ultimately, Celsius is building a machine that converts Miles into Margin more efficiently than any competitor. The near-term goal is to scale this machine while protecting the discipline that makes it profitable.

| Category | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

|---|

Comprehensive analysis of customer concentration, lane-level profitability, protein freight advantage, and strategic positioning within the temperature-controlled freight network.

FREIGHTMATH DASHBOARDThe top four customers account for 46.4% of total Over the Road volume over the last four weeks, with a Core Operating Ratio of 97.3 versus a network average of 108.3. Performance among these customers has been consistently strong, with Operating Ratio remaining below 100 across the 18 months and falling below 93.0 in nine of the last twenty periods. This concentration reflects a material share of network economics being anchored by a small group of large, operationally stable shippers that have delivered durable profitability relative to the broader book of business.

At the lane level, this concentration is balanced across both high-density and specialized freight patterns. Approximately 32% of top four customer volume moves on 18 Power Lanes (highest density lanes), representing 15% of total network's freight and producing a 95.8 Operating Ratio. Density within a network allows a carrier to increase velocity by eliminating operational and real-world obstacles and improving efficiency. This improvement to the speed at which freight moves through the network drives network profitability.

An additional 20% of their volume moves on Spider Lanes (lowest density lanes), which operate at a 94.0 Operating Ratio despite lower volume, largely driven by protein-related freight. Together, these patterns illustrate that customer concentration is supported not only by scale lanes, but also by defensible, specialized lane pairs that sustain pricing power. This mix enhances operational durability by combining density-driven efficiency with niche lane profitability, while also shaping the scalability profile of the network around a limited number of high-impact customers.

From August 2024 through the current period, protein-related customers (ie; beef, pork, poultry, etc) have represented a consistent and meaningful portion of the over-the-road network, accounting for approximately 28% to 34% of total freight. At the lane level, this freight category exhibits a favorable concentration and diversification profile, combining repeatable customer participation with strong underlying economics. Core ORs for protein freight averaged around 93 over this period, never exceeding 96 as a group and reaching lows near 88. Compared to other commodity types in the network, protein lanes consistently performed 15% to 20% better on Core OR, pointing to a structurally advantaged segment rather than performance driven by a single year or isolated market conditions.

This performance has important strategic implications for network design and earnings stability. The FreightMath Operating Ratio (Network Fit) score for protein lanes outperforms the network average, largely driven by the lower operating ratios of the freight itself rather than by customer diversification effects alone. As market conditions improve and lift profitability across other commodity types, the relative network fit, and operating ratio of protein freight is positioned to improve further. This reinforces protein lanes as both a stabilizing component during softer markets and a compounding contributor as the broader freight environment strengthens, supporting sustained network-level profitability over time.

Over the past three months, 26% of the OTR network's volume has moved on 53 high-density lanes averaging at least one load per day. These lanes represent the most consistent and operationally important portion of the network, driving equipment utilization and day-to-day network stability.

Within this core set, customer concentration is high. Only 13 of the 53 lanes have a top customer accounting for less than 85% of total lane volume, while the remaining lanes are predominantly single-customer in nature, with 95% to 100% of freight tied to one shipper. This structure reflects strong lane incumbency but also means a relatively small number of customer decisions influences a disproportionate share of the carrier's most productive freight.

Bubble size represents total loads. X-axis shows top customer share, Y-axis shows loads per day.

While high volume lanes are vulnerable to single customer freight, the OTR network is dense from an area perspective. In terms of volume, the top 20 markets for this network have multiple market shippers and inbound/outbound areas.

Operating under multiple Bill To Names, Kroger overall represents 5.8% of the OTR network, making it a meaningful but not dominant customer at the network level. Rates on this freight run 23% below the network average, which could position it structurally as backhaul volume. However, origin/destination performance indicates a different dynamic. The FreightMath Operating Ratio for Kroger freight is 8.1 points worse than the network average, and the Core OR of 151.1 limits any ability to recover margin either before or after these loads. While backhaul freight can play a productive role in connecting profitable areas, its effectiveness depends on manageable losses at the lane level and its ability to connect profitable areas together. In this case, the magnitude of loss embedded in the freight materially constrains network flexibility.

Since May 2025, Kroger's load volume has increased by 20%, coinciding with a significant deterioration in quality. Core OR rose from 120.4 to 151.1, while the share of loads operating at a better-than-average FreightMath OR has declined from 19.7% to 8.9%. This reflects growing concentration in underperforming lanes rather than diversified, network-supportive coverage. Although the destination markets exhibit an outbound Core OR near breakeven, the inbound losses are substantial enough to overwhelm downstream performance. At the lane level, this pattern indicates that current pricing and mix are not aligned with scalable network economics, and performance improvement would require broad-based rate adjustments across multiple lanes rather than isolated optimization.

Over the past four weeks, the Chicago market has been oversold by 219 loads, representing a 34 percent imbalance driven by inbound volume. Inbound freight into Chicago is structurally unprofitable, operating at a Core OR of 138.3, and typical recovery areas for deadhead capacity such as Milwaukee and Indianapolis show similarly weak economics. While outbound Chicago lanes are the heaviest in the network and perform strongly at a Core OR of 81.1, this outbound strength masks persistent inbound underperformance rather than resolving it.

Inbound customer exposure is broadly diversified, with no single shipper representing more than 11% of volume, indicating pricing pressure is distributed across a wide customer base rather than concentrated in a small number of accounts. This mix highlights a lane-level structure where diversification limits single-customer risk but also reduces pricing leverage, making margin recovery dependent on systematic rate action across shippers.

Inbound Florida represents 5% of the OTR's network. Because outbound Florida rates are persistently constrained by supply and demand imbalance, inbound lanes must generate above-average contribution to offset predictable downstream losses. Performance varies meaningfully by lane and customer, highlighting the importance of lane-level economics rather than aggregate market exposure when assessing durability and scalability.

The GA-ALB (Albany) to FL-SAR (Sarasota) lane for Wal-Mart represents the most immediate concentration issue. This lane consistently exceeds 10 loads per week, operates below a profitable operating ratio, and carries incremental trailer pool costs at the Thomasville, GA facility. The combination of high volume, single-customer dependence, and structural cost drag makes this lane disproportionately influential on overall Florida inbound performance. While the volume supports scale, the current economics limit its ability to subsidize weaker outbound Florida freight.

Additional inbound exposure comes from lower-volume lanes originating in the Northeast and Texas, averaging roughly six loads per week. These lanes face suppressed outbound rates that are further degraded by Florida connectivity, resulting in a 102.2 Core OR and a materially weaker 113.0 FreightMath OR that reflects poor network fit. In contrast, the CO-DEN to FL-ORL lane for Cargill operates at a strong 90.0 OR with appropriate pricing, but extended dwell times exceeding four hours at both origin and destination, combined with below-average velocity on a long haul, constrain throughput efficiency. Collectively, these patterns underscore how customer concentration, operational friction, and lane velocity, not just rate adequacy, determine whether Florida inbound freight strengthens or dilutes network economics.

The Phoenix market is centered around the outbound freight for Red Bull/Geodis, with 78% coming from this one customer. This structure produces a weak economic profile upstream, with Phoenix-originating freight operating at a Core OR of 115.0 and inbound freight positioning trucks into Phoenix performing even worse at a 124.8 Core OR. Alternative truck supply options are limited, as sourcing equipment from Los Angeles requires more than 370 unpaid deadhead miles, reinforcing the dependence on suboptimal inbound freight to support the outbound network.

While the outbound destinations tied to this freight generate a strong 96.2 Core OR that exceeds network averages, that performance is insufficient to offset losses incurred in the prior legs. As a result, the full network-adjusted FreightMath OR for this traffic is 123.9. The data indicates that lane-level customer concentration in Phoenix constrains flexibility and magnifies the impact of weak inbound economics. Improving durability and scalability in this market would require either materially higher outbound pricing to compensate for the network drag (around $0.50 per mile), or a broader mix of profitable inbound freight to rebalance the lane economics.

Conagra Foods' recent performance reflects limited lane-level diversification within an overall underperforming footprint, ranking second highest in FreightMath Operating Ratio among shippers with material volume. With a FreightMath OR of 118.4 and a Core OR of 120.3 over the last four weeks, the majority of Conagra's volume is concentrated on lanes operating worse than network averages. Only 3 of 18 active lanes generate better than average FreightMath OR results, representing just 11 percent of total loads, and none of these lanes are high-density Power Lanes within the OTR network. Elevated origin and destination ORs of 118.3 and 111.5 indicate that performance pressure is broad-based rather than confined to a small subset of lanes. As a result, outcomes are driven by a narrow set of consistently underperforming corridors, limiting operating leverage, reducing network optionality, and constraining the ability for incremental volume to improve overall economics.

The OTR network demonstrates disciplined use of broker freight, with broker loads and miles representing just over 7% of total activity, which is down from 19% earlier in 2025. These numbers are also well below peer benchmarks. While broker freight carries a structurally higher Core Operating Ratio than shipper freight, its FreightMath Operating Ratio is less than three points above the network average. This indicates that broker freight is being deployed selectively in ways that align with overall network economics rather than as a broad capacity substitute. At the network level, brokers appear to function as a connective mechanism that supports profitable freight flows instead of diluting margin performance.

At the lane level, this strategy is most visible in key outbound markets such as Houston and Atlanta. Both lanes exhibit higher broker concentration than the network average, yet broker freight in these markets outperforms shipper freight on a FreightMath OR basis. This suggests that broker usage in these lanes is not driven by shipper dependency or pricing pressure, but by targeted diversification that enhances optionality and resilience. By maintaining strong lane-level economics while blending customer types, the network improves its ability to scale volume, adapt to demand shifts, and preserve profitability across market cycles.

KSMTA's FreightFit asset and logistics overlay highlights a network that is already structurally aligned for selective conversion between brokered and asset-based freight. The optimized view surfaces opportunities where asset capacity and lane coverage already exist, allowing freight to be absorbed with minimal disruption, while also identifying markets where shifting freight back to logistics improves overall balance. These findings are directional rather than prescriptive, reflecting how the current network behaves under optimization rather than a one-time tactical adjustment.

Customer concentration is a defining feature of the conversion opportunity. Approximately 78 percent of the freight identified for transition to the asset network is concentrated across three large shippers: Walmart, Costco, and Kroger. A significant share of this volume is intra-California, forming a cohesive lane set with expedited characteristics. This level of concentration underscores that incremental asset utilization gains are being driven by a small number of customers with repeatable, dense freight patterns rather than a broad base of fragmented demand.

The most substantial non-intra-California opportunity is tied to Walmart Produce, which generated 213 loads across 14 outbound California lanes over the past four weeks. The asset network already operates on 13 of these 14 lanes, indicating existing operational familiarity and capacity alignment. Nearly all lanes received full model acceptance, and the freight profile is long-haul in nature, averaging 1,700 miles per load at a $3.16 linehaul plus fuel rate. From a network perspective, this reflects a scalable conversion opportunity rooted in lane overlap and consistency rather than incremental complexity.

The model also identifies targeted cases where asset freight is better suited for logistics execution. Inbound Denver stands out, with 35 percent of asset freight rejected, largely originating from Dallas, Salt Lake City, and Indianapolis. Given Denver's below-average profitability, this shift removes lower-rated freight from oversupplied markets while improving balance in the Denver region. Los Angeles shows a similar dynamic on the outbound side, where a small percentage of loads were displaced to logistics as the model prioritized higher-performing outbound freight. Together, these patterns illustrate how lane-level customer concentration and market balance influence both conversion potential and network durability.

A Comprehensive Analysis of Market Dynamics, Technological Deployment, and Regulatory Frameworks (2025–2035)

The United States trucking industry, responsible for moving over 72% of the nation's freight by weight, stands at the precipice of a fundamental structural transformation in 2025. After a decade of speculative investment, closed-course testing, and pilot programs, the sector is aggressively transitioning into the early stages of commercialization.

Current market intelligence indicates that the global autonomous long-haul trucking market, valued at approximately $2.7 billion in 2024, is projected to reach an estimated $42.6 billion by 2034—a Compound Annual Growth Rate (CAGR) of 32%.

The convergence of SAE Level 4 (L4) autonomous driving systems—capable of operating without human intervention within specific Operational Design Domains (ODDs)—with a chronic driver shortage projected to exceed 160,000 unfilled positions by 2030, has created an irresistible economic imperative. The potential to reduce Total Cost of Ownership (TCO) by up to 40% through 24/7 asset utilization serves as the primary catalyst for this shift.

The most cited driver for automation is the persistent shortage of qualified commercial truck drivers. The American Trucking Associations (ATA) reports a widening gap between freight demand and available workforce.

Autonomous trucking addresses this structural deficit by restructuring the job. The prevailing "Hub-to-Hub" model envisions autonomous trucks handling the long, monotonous interstate segments (the "middle mile"), while human drivers are redeployed to shorter, regional, and urban routes ("first and last mile"). This shift transforms truck driving into a job that allows for nightly returns home.

In the current human-centric model, a truck's utilization is legally capped by Hours of Service (HOS) regulations—generally limiting a driver to 11 hours of driving within a 14-hour window, followed by a mandatory 10-hour break. This means that for nearly half of every day, a capital asset worth $150,000–$200,000 sits idle.

The adoption of autonomous trucking will not be a monolithic wave but rather a tiered rollout dictated by the complexity of the Operational Design Domain (ODD), economic incentives, and regulatory friction.

OTR represents the "beachhead" market for AV developers. The interstate highway system offers a structured, semi-predictable environment significantly easier for AI to navigate than urban centers.

Dedicated trucking involves moving freight on consistent, repetitive routes for a single customer. This predictability makes it ideal for early autonomy adoption.

Short-haul and drayage operations present a significantly more complex ODD—dense urban traffic, frequent stops, complex intersections, and unpredictable interactions.

Probability is bifurcated: extremely low for public road Hazmat/Oversize due to regulatory risk, but high for private road industrial applications.

Strategy: "Aurora Driver" hardware/software stack designed to be vehicle-agnostic. Driver-as-a-Service business model.

Partnerships: PACCAR (Peterbilt/Kenworth), Volvo Trucks

Milestone: 2025 expansion to Fort Worth-El Paso route (+600 miles)

Strategy: Modular "SensorPod" technology simplifies maintenance. Dual-use applications (public roads + industrial).

Differentiator: Permian Basin frac sand hauling with Atlas Energy Solutions

Financials: Public via SPAC (2025), ~$2.5B valuation

Strategy: Evolutionary approach—L2++ "PlusDrive" generating revenue while developing L4 "SuperDrive"

Partnership: TRATON Group (Scania, MAN, International)

Validation: Driver-out testing completed at TRC Ohio

Strategy: "Integrated OEM" model as Daimler subsidiary. Co-developing chassis with redundant systems from ground up.

Platform: Autonomous-Ready Freightliner Cascadia

Approach: "Product-grade" truck vs. retrofitted prototype

Status: Trucking program paused in 2023 to focus on Robotaxi (Waymo One)

Implication: Withdrawal allowed Aurora and Kodiak to consolidate market share

Note: Retains IP and capability to re-enter

Niche: Middle-mile B2B logistics using Class 3-6 box trucks (not Class 8)

Clients: Walmart, Kroger, Tyson Foods

Model: Short fixed routes, constrained ODD (e.g., right turns only)

The role of the OEM has shifted from hardware supplier to platform integrator. Autonomy requires "redundancy-ready" architecture—backup systems for every critical function.

| OEM | AV Partner | Strategy | Launch |

|---|---|---|---|

| Daimler (Freightliner) | Torc Robotics | Vertical Integration: "Gen 5" Autonomous Cascadia | 2027 |

| PACCAR (Peterbilt/KW) | Aurora | Partnership: Aurora Driver on Peterbilt 579, KW T680 | 2025 |

| Volvo Trucks | Aurora | Partnership: "Volvo VNL Autonomous" with redundant systems | 2025/26 |

| International (Traton) | Plus | Partnership: SuperDrive integration, global scale for cost reduction | 2027 |

The regulatory landscape is characterized by a dichotomy between a supportive federal framework striving to modernize safety standards and a patchwork of state laws ranging from enthusiastic deregulation to outright bans.

Aims to create a unified federal framework, preempting state-level bans on autonomous trucks provided they meet federal safety standards. Directs FMCSA to update regulations by 2027 to clearly define the legal status of autonomous systems, exempting AVs from human-specific rules (drug testing, physical exams, HOS).

Actively distinguishing between "driver-assist" and "driver-replaced" technologies. SGO 2021-01 (Standing General Order) requires crash reporting for ADS—data indicates autonomous trucks maintain remarkable safety records during testing.

DOT studies suggest a nuanced shift: while long-haul driving jobs may decrease, they will be offset by increases in short-haul roles and new technical positions (remote monitoring, fleet maintenance, AV dispatching). Framed as workforce transition, not elimination.

SB 2205 explicitly allows AV deployment without human driver. Insurance, traffic law compliance, and recording devices required. Created the "Texas Triangle" launchpad.

2025: DMV proposed regulations to lift heavy-duty AV testing ban with phased permitted process. Faces fierce opposition from Teamsters. AB 316 (human operator mandate) vetoed by Governor Newsom.

Regulations aligned with Texas, forming contiguous "autonomous corridor" along I-10. Enables seamless Houston-to-Phoenix operations.

States like Delaware have introduced legislation to preemptively ban driverless trucks, mirroring California's labor concerns. Creates emerging "regulatory wall."

In a traditional accident, liability splits between driver (negligence) and carrier (vicarious liability). In an autonomous crash, liability shifts toward Product Liability—resting with the Manufacturer (Aurora, etc.) or OEM if integrated. Insurance models are evolving to underwrite based on AV stack technical maturity rather than human driving history.

For an autonomous truck to operate commercially, it must interact with existing roadside enforcement infrastructure. A robot cannot speak to a state trooper, nor step out to check its own brakes. The industry has developed digital proxies for these physical interactions.

This program is arguably the most critical operational enabler for the industry. The CVSA has approved a new standard specifically for Level 4/5 autonomous trucks, removing the need for roadside stops.

Rigorous "Enhanced CMV Inspection" by CVSA-certified technician at dispatch terminal. "No-Defect" Standard—vehicle must be completely defect-free to launch.

Once passed, the truck is valid for 24-hour operational window (or until trip end). "Digital validity" travels with the truck.

Truck wirelessly communicates inspection status to law enforcement. Valid "green light" = bypass weigh stations. Fault detected = flagged to pull over.

Unlike Levels I-V (physical checks), Level VIII is a wireless inspection conducted while the vehicle is moving, without direct enforcement officer interaction.

Creates a "digital license plate" and "digital logbook" read automatically at highway speeds.

Technology providers like Drivewyze integrate directly into autonomous stacks. Using geofencing, the system detects weigh station approach and transmits carrier safety scores, registration, and IFTA data. Coupled with CVSA Enhanced Inspection results, compliant trucks receive bypass signals—crucial since navigating crowded weigh station ramps adds unnecessary risk and time.

The rollout of autonomous trucking will be evolutionary, not revolutionary—beginning with specific lanes and expanding as the technological ODD widens and the regulatory patchwork unifies.

"Driver-out" operations on limited OTR lanes. Small fleets (dozens of trucks). Focus on safety validation and data gathering.

Expansion to longer routes (TX→CA, TX→GA). Introduction of scalable factory-built chassis from Daimler, Volvo, and International.

Integration into major logistics networks (FedEx, UPS). Significant volume on dedicated lanes. ~10% of new sales.

Expansion into weather-challenged regions (Snow Belt). High penetration in OTR. Mixed fleets become the norm.

The future of autonomous trucking in the United States is no longer a question of "if," but "how fast." The technology for highway autonomy has matured to the point of commercial viability, evidenced by 2025 commercial launches by Aurora and Kodiak, and impending 2027 entry by Daimler/Torc.

As 2025 unfolds, the industry is stepping out of the sandbox and onto the interstate, poised to redefine the movement of goods in the 21st century.

A scaled, temperature-controlled dedicated fleet with proven financial performance, positioned as the foundation for Expedited service expansion.

The Dedicated network operates as a contracted, asset-based transportation solution serving a defined customer base with assigned equipment and drivers. Unlike transactional freight, Dedicated volumes are planned, routes are repeatable, and capacity is committed, creating a stable operating environment with strong financial performance. Over the past 19 months, the network has delivered an average Operating Ratio of 95.2%, with recent performance improving to 93.7% over the last six months.

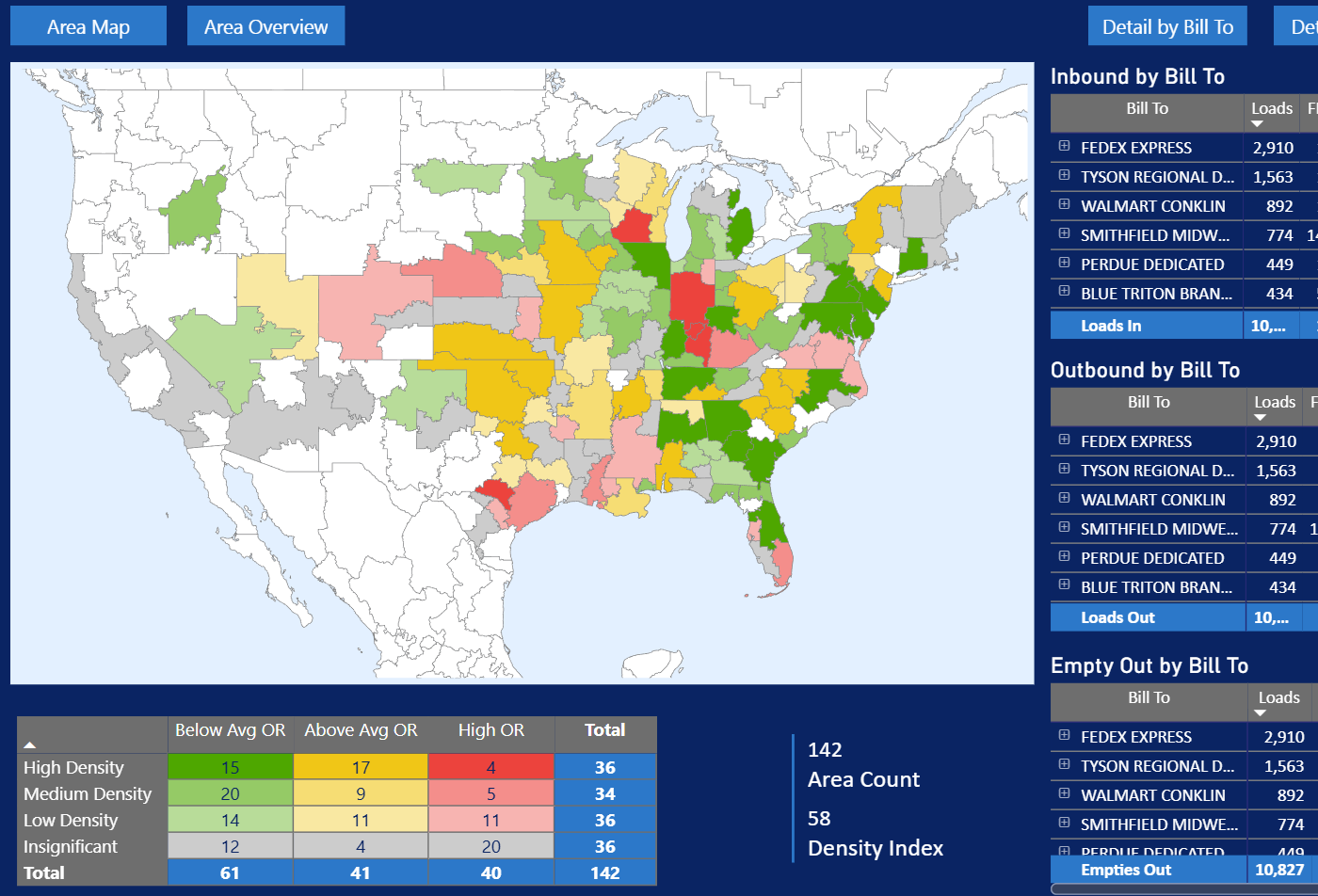

The network spans 142 operating areas and encompasses over 1,100 analyzed lanes, reflecting geographic reach combined with operational density. Load volumes are balanced: inbound and outbound movements align closely, reducing empty repositioning and supporting efficient asset utilization.

This combination of financial discipline, network density, and operational predictability positions the Dedicated division as a natural platform for layering additional service tiers, specifically an Expedited offering designed for customers requiring tighter transit windows and enhanced reliability.

The Expedited network should be positioned as a service tier layered onto the existing Dedicated network, not as a standalone offering. The commercial message should lead with reliability, control, and risk reduction rather than speed alone. Because the underlying network is dense and balanced, Expedited volumes can be accommodated with limited incremental complexity, allowing pricing to reflect service certainty and performance.

For existing Dedicated customers, Expedited represents a natural upgrade path, offering tighter transit commitments on lanes they already ship without requiring new carrier relationships or operational onboarding. For prospects, leading with the stability of the Dedicated platform before introducing Expedited establishes credibility and differentiates the offering from commodity time-definite services.